Article Highlights

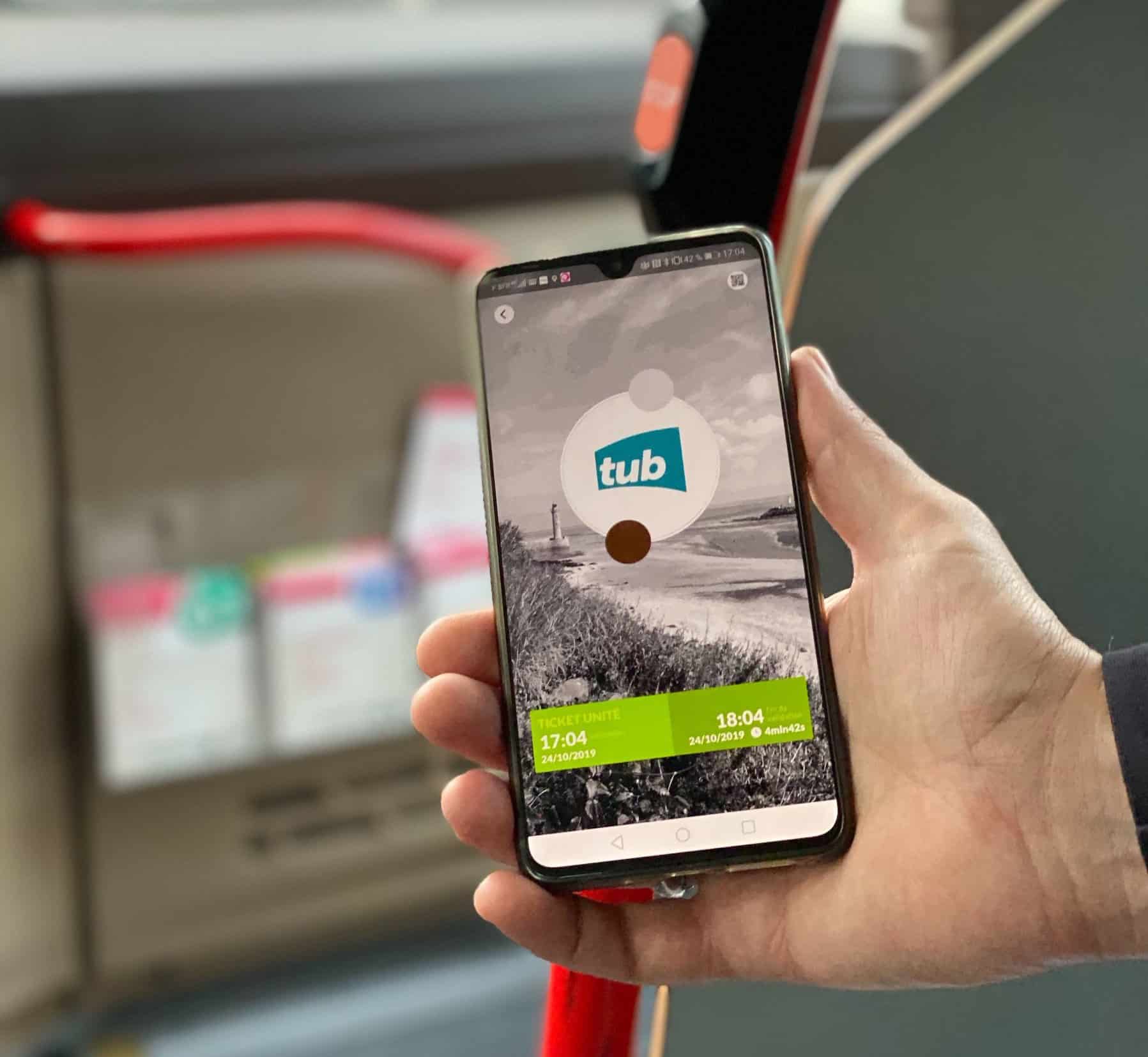

The trip-planning Transit app has announced a deal with France-based Paragon ID, as it seeks to recruit more transit agencies to sell their tickets in its app. Paragon ID provides a SaaS mobile-ticketing platform using technology from majority-owned Airweb. Transit already works with at least three other SaaS ticketing providers.

Transit already works with UK-based Masabi and U.S.-based Token Transit, as well as Bytemark, a subsidiary of Germany-based Siemens Mobility, to offer ticketing and payments in more than 60 transit agencies, most in the U.S.

• Transit

• Paragon ID

• Airweb

• Masabi

• Token Transit

The trip-planning app provider Transit has added another mobile-ticketing and payments provider as it continues to seek to enable users to plan, book and pay for rides from its app. It already works with at least three other software-as-a-service mobile-ticketing providers.