Article Highlights

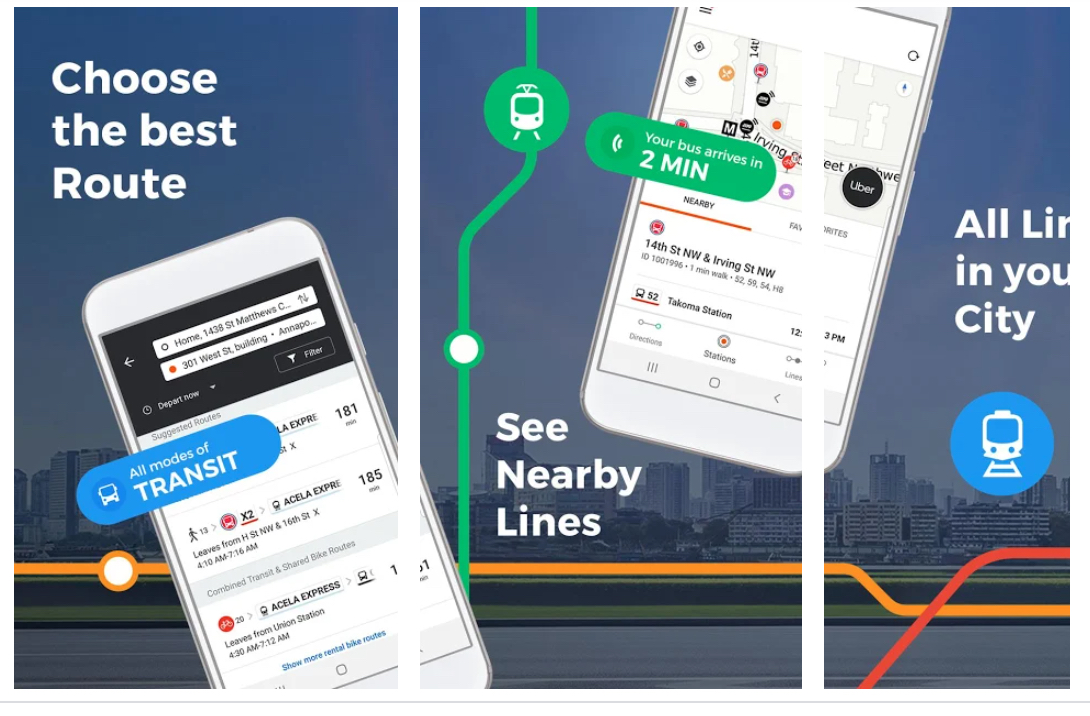

Moovit plans to enable more public transit agencies to sell their tickets through its app. Providing ticketing and payments will also help Moovit keep pace with rival trip-planning apps, such as Transit, which also are beginning to enable users to book and pay for trips on buses, trains and other transit modes.

The NEORide consortium is planning to enable contactless EMV payments, as well. The consortium is now installing more than 1,000 validators on buses through Masabi. The units cost $1,200 apiece, plus $425 per unit for installation, not counting warranty and training.

• Moovit

• NEORide Consortium

• Masabi

• Cubic

Moovit, which bills itself as the world’s largest “urban mobility app,” has begun to enable public transit ticketing and payments from its platform, as it seeks to deliver what it says is a true mobility-as-a-service experience for users.