Article Highlights

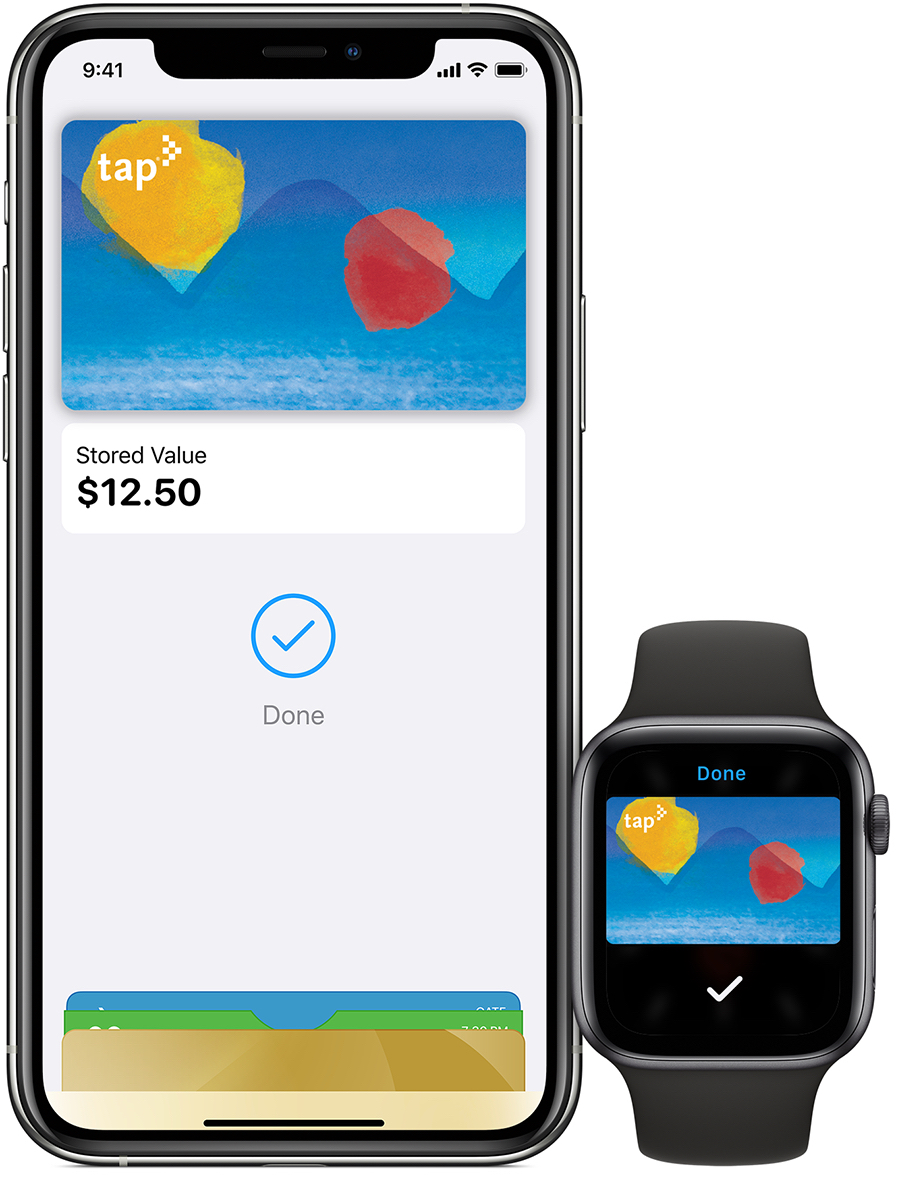

Metro’s virtual TAP card for Apple Pay will be very similar to the virtual SmarTrip card WMATA announced earlier. Both will enable users to add the virtual cards and reload them with value in both the Apple Wallet and in a separate agency app for iOS devices. The virtual cards can only be used in the Apple Wallet.

Once on the devices, Metro customers can pay for rides or redeem passes on buses and light rail, as well as rides with 25 transit agencies in Los Angeles County that accept TAP.

• (LA) Metro

• Apple

• WMATA

• Cubic

Another major U.S. transit agency has introduced a virtual closed-loop card for Apple Pay this week, with the Los Angeles County Metropolitan Transportation Authority, or Metro, It comes a couple of days after the Washington (D.C.) Metropolitan Area Transit Authority, or WMATA, announced it had put its SmarTrip closed-loop card on Apple’s NFC-enabled devices, as well.