Article Highlights

The public transit ticketing feature in the Uber app, while not widely used, is part of the ride-hailing service’s initiative to incorporate other modes of transit in its app to offer a mobility-as-a-service, or MaaS, platform. MaaS is a much-touted development in the transportation industry that is supposed to enable users to plan, book and pay for door-to-door transit from the same app. But it has so far failed to live up to the hype.

All told, there were a total of 68,300 EZfare tickets sold by NEORide in December 2019, when all or nearly all of the group’s 13 agencies were on board with the mobile-ticketing service. Just under 43,400 of those tickets were sold through the Transit app. Total mobile ticket sales increased by 20% to 82,000 the next month, January 2020, with 52,000 of those tickets sold through Transit. Ticket sales dipped by 6% to 7% to 77,000 in February, the last full month unaffected by the pandemic lockdowns.

• Uber

• NEORide

• Masabi

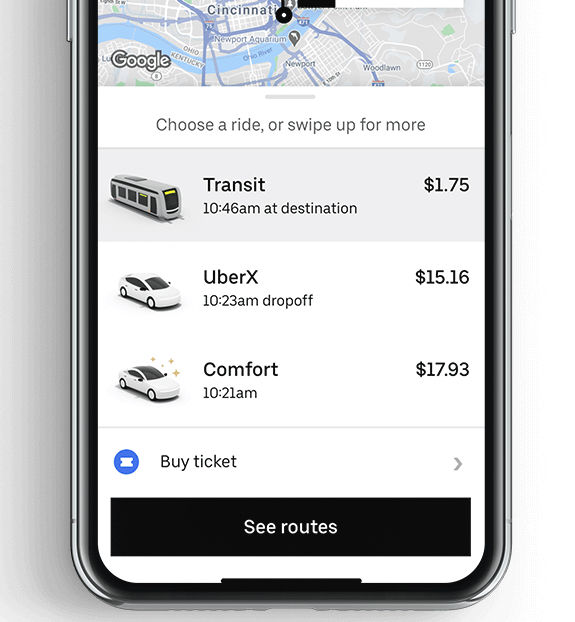

As expected, Uber has expanded support for public transit ticketing in its app again, this time to a consortium of 13 small and mid-tier transit agencies in Ohio and Northern Kentucky–following two other U.S. transit agencies, in Denver and Las Vegas, which have already integrated with Uber–it was announced today.