Article Highlights

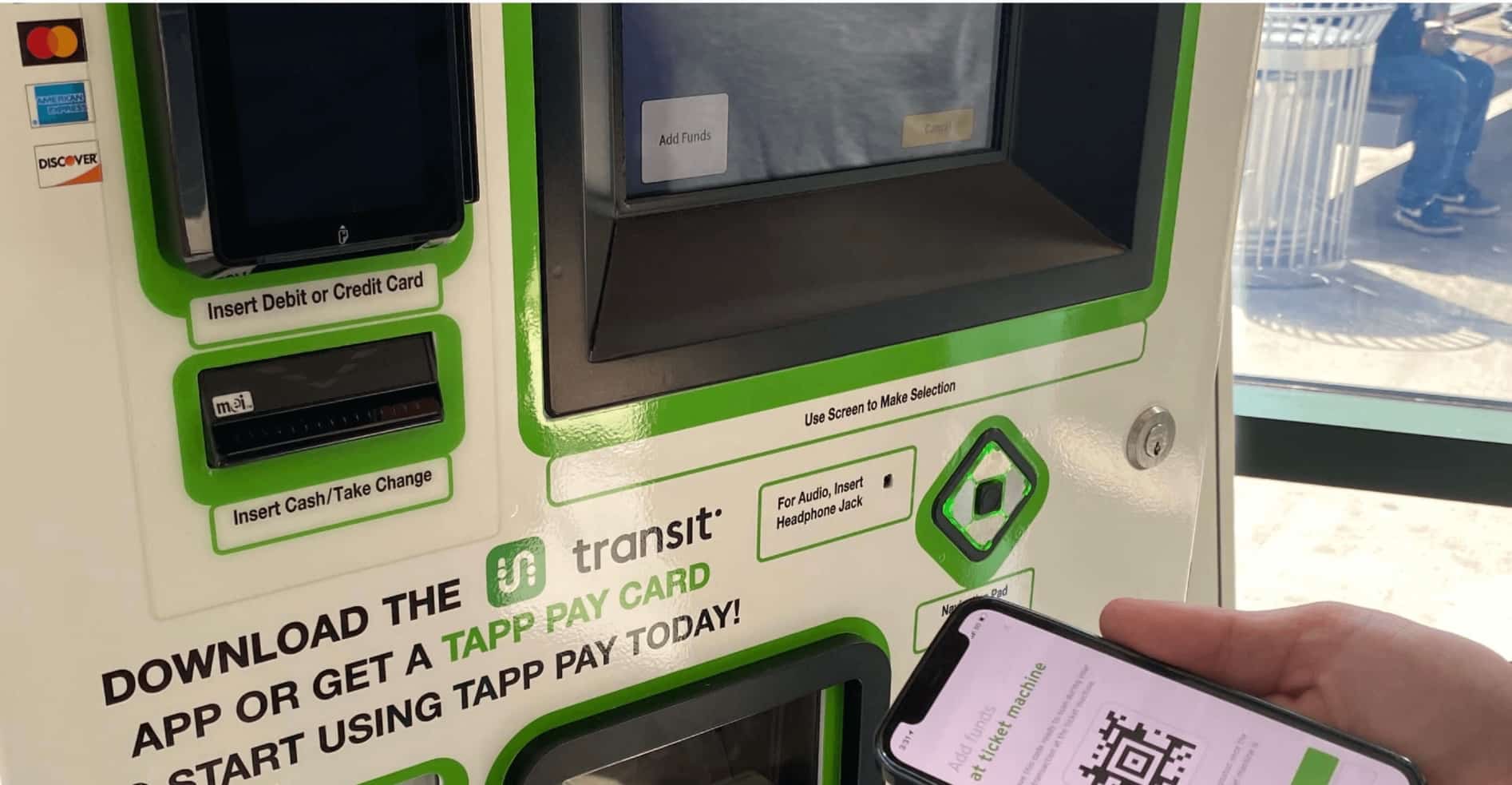

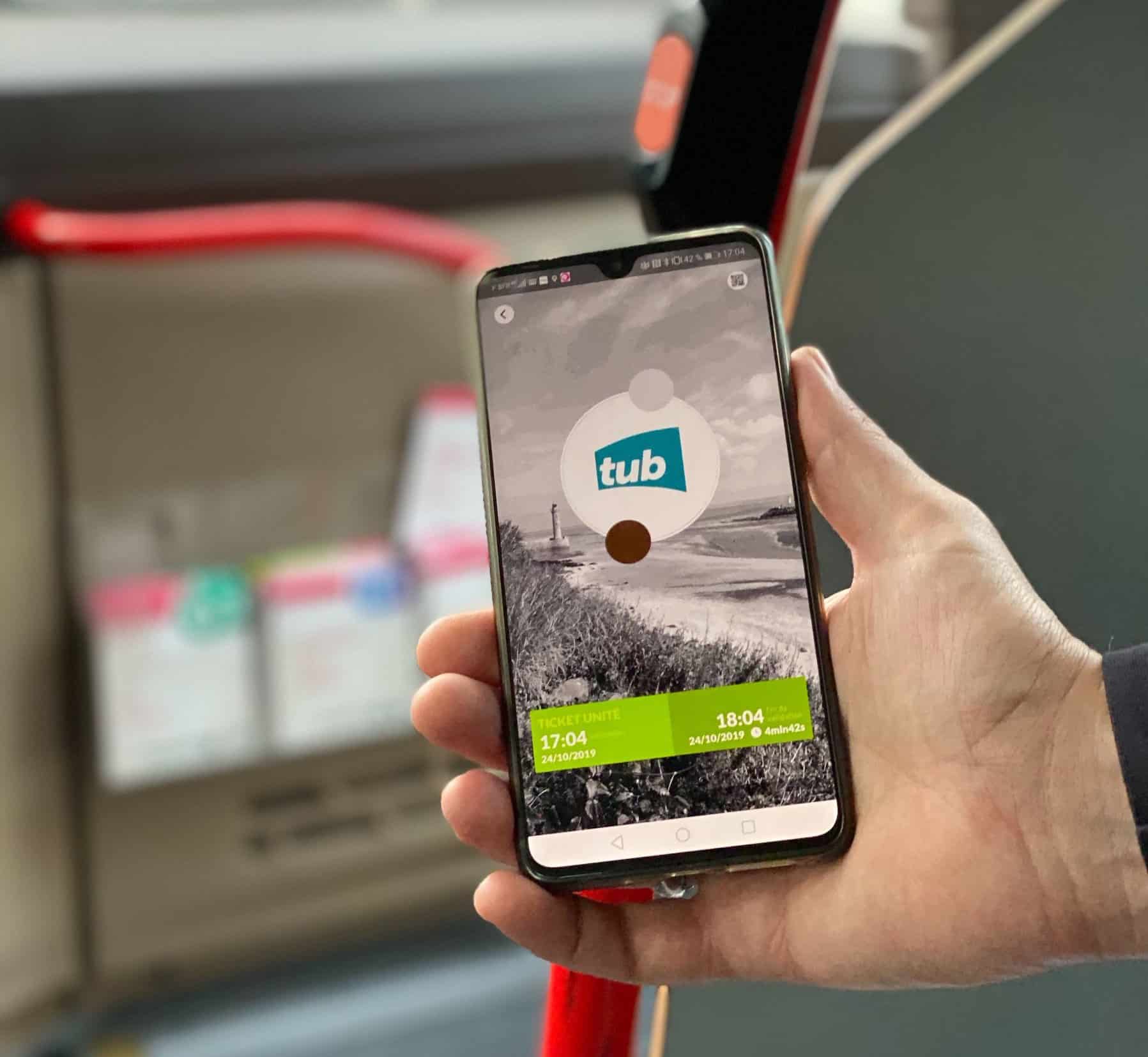

Montreal-based Transit, which has a strong presence in North America for trip-planning, is among the first such apps to enable ticketing and payments, connecting to software-as-a-service ticketing platforms like UK-based Masabi, U.S.-based Token Transit and, more recently, U.S.-based Bytemark.

Table: SaaS ticketing platform providers–major agencies, pricing, trip-planning apps working with

• Transit

• Moovit

• Masabi

• Token Transit

• Bytemark

The trip-planning Transit app announced that it has handled more than 1 million fare transactions since April 2019, when it started enabling ticketing and payments through its app. Although ticketing through third-party apps still make up a small percentage of fare payments for agencies, Transit says the transactions are growing rapidly.