Article Highlights

Finland-based MaaS Global, creator of the pioneering Whim app, believes it can monetize the half million users of the Quicko app in Brazil. MaaS Global acquired the Brazilian start-up in an all-stock deal. MaaS Global has been hit hard by the pandemic, which is believed to have squeezed its finances. CEO Sampo Hietanen tells Mobility Payments that industry doubts about mobility as a service are premature.

MaaS Global reportedly burned through most of the €60 million (US$66 million) in funding it had raised as of last June. In August, the company got a much-needed infusion of €11 million (US$13 million), which would help the MaaS Global expand into “selected markets” and provide capital for continuing operations.

• MaaS Global

• Quicko

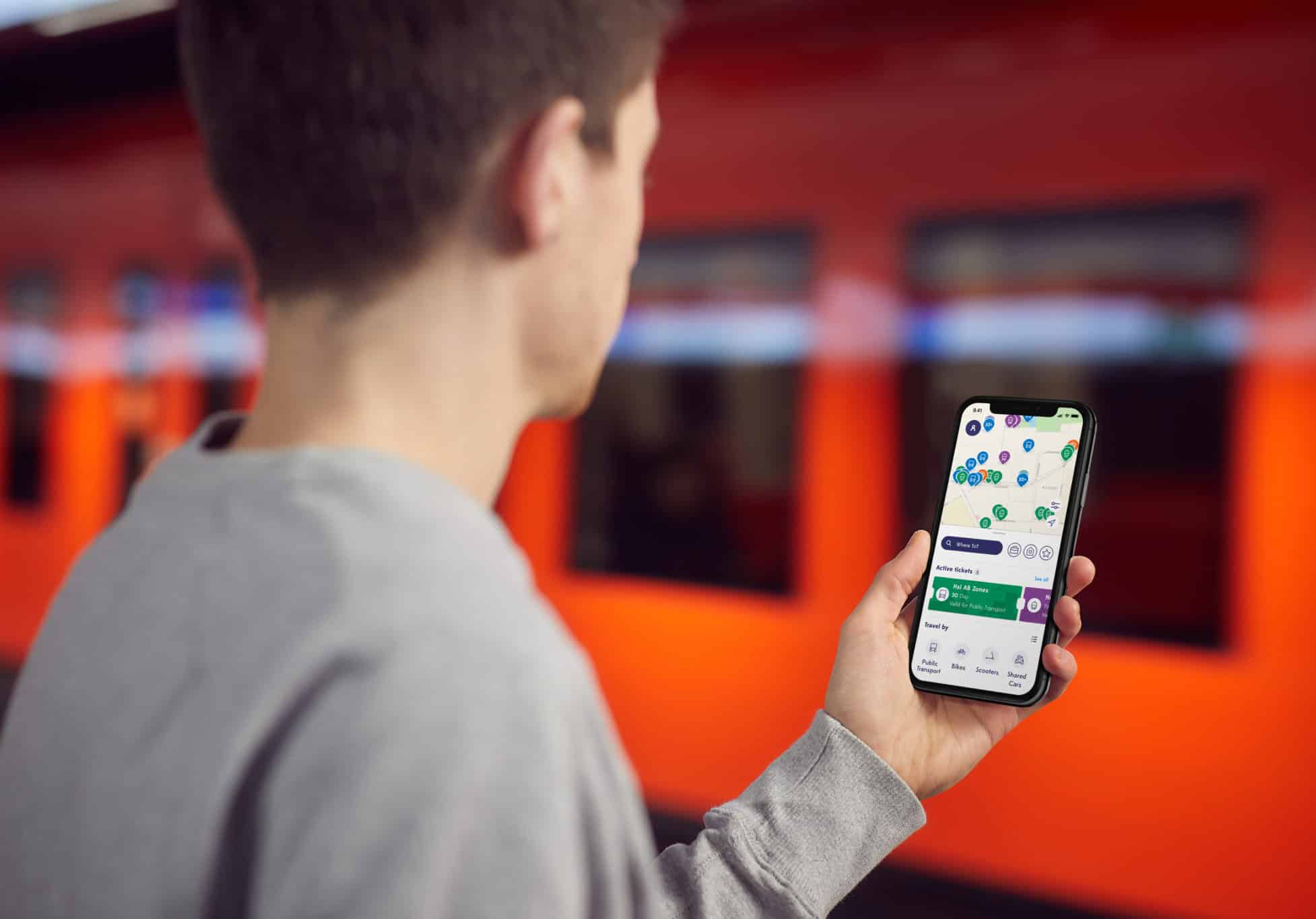

Sampo Hietanen, CEO of Finland-based MaaS Global, said his company’s acquisition of the Brazilian trip-planning and tracking app Quicko would help turn the app into a full-fledged mobility-as-a-service platform, while building scale for MaaS Global and its Whim technology.