Article Highlights

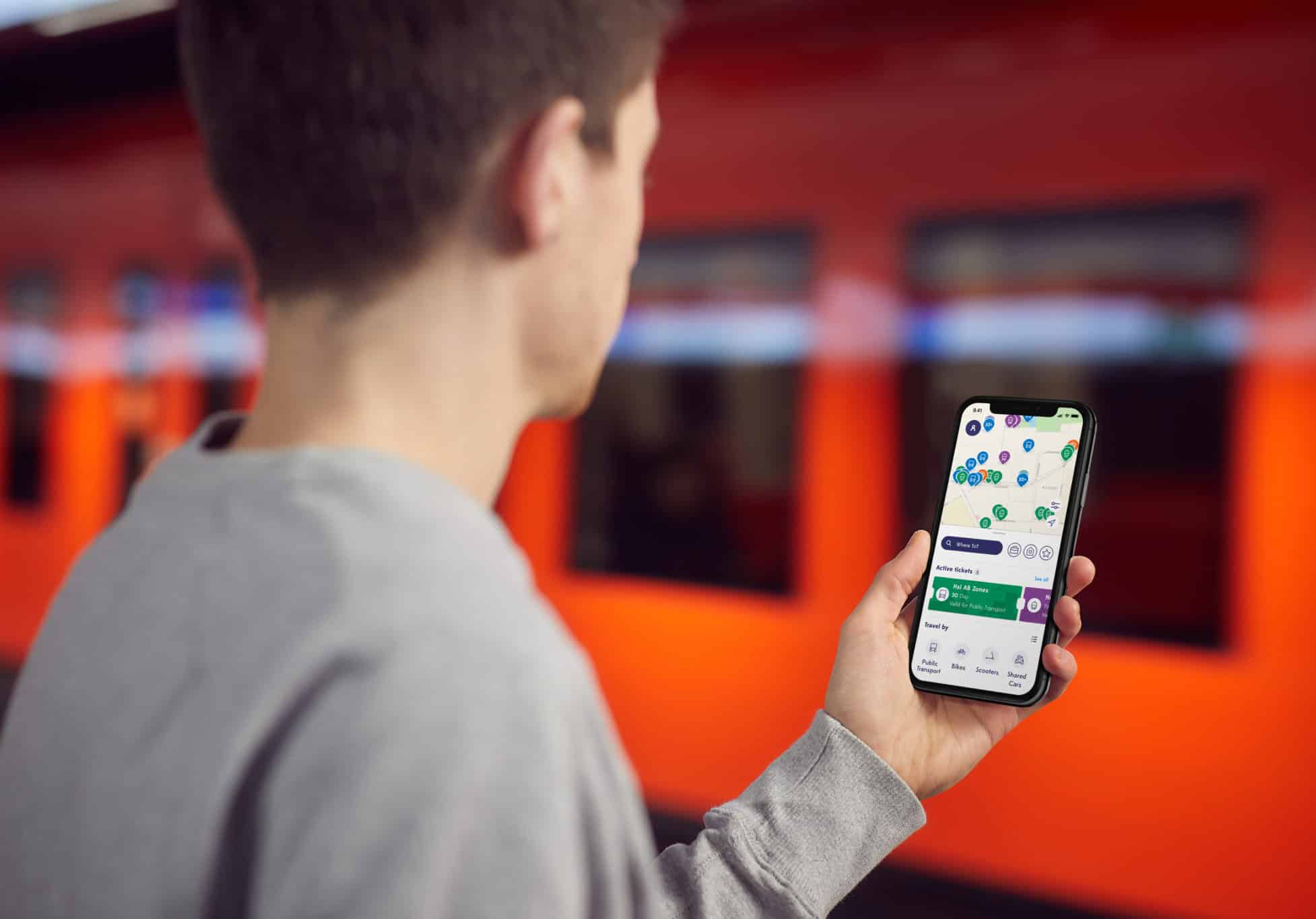

Pioneering mobility-as-a-service start-up MaaS Global plans to drop its B2C business model and will instead try to license its Whim platform and expertise to non-transport companies that want to launch MaaS to their customers, Mobility Payments has learned.

Hietanen is facing a serious cash crunch. This forced the layoffs of around 25 in Finland and also the closing last month of MaaS Global’s Brazilian operation and the Quicko trip-planning app it had acquired only six months earlier. Quicko’s demise resulted in the termination of around 60 employees.

• MaaS Global

• Mitsui Fudosan

• Capitello Move

Pioneering mobility-as-a-service start-up MaaS Global plans to drop its B2C business model and will instead try to license its Whim platform and expertise to non-transport companies that want to launch MaaS to their customers, Mobility Payments has learned.