Article Highlights

The NEORide group, which handles fare collection for more than a dozen agencies in the U.S. states of Ohio, Kentucky and Michigan says 55% of its mobile tickets are sold through the Transit app, which is the default mobile app for the group’s largest agency, Metro of Cincinnati.

Mobile tickets sales for 500,000 trips purchased through the Transit app since late 2019 to the present compares with total ridership of 600,000 per month alone in 2020 for the largest NEORide agency, Metro in Cincinnati.

• NEORide

• Transit

• Moovit

• Uber

• Masabi

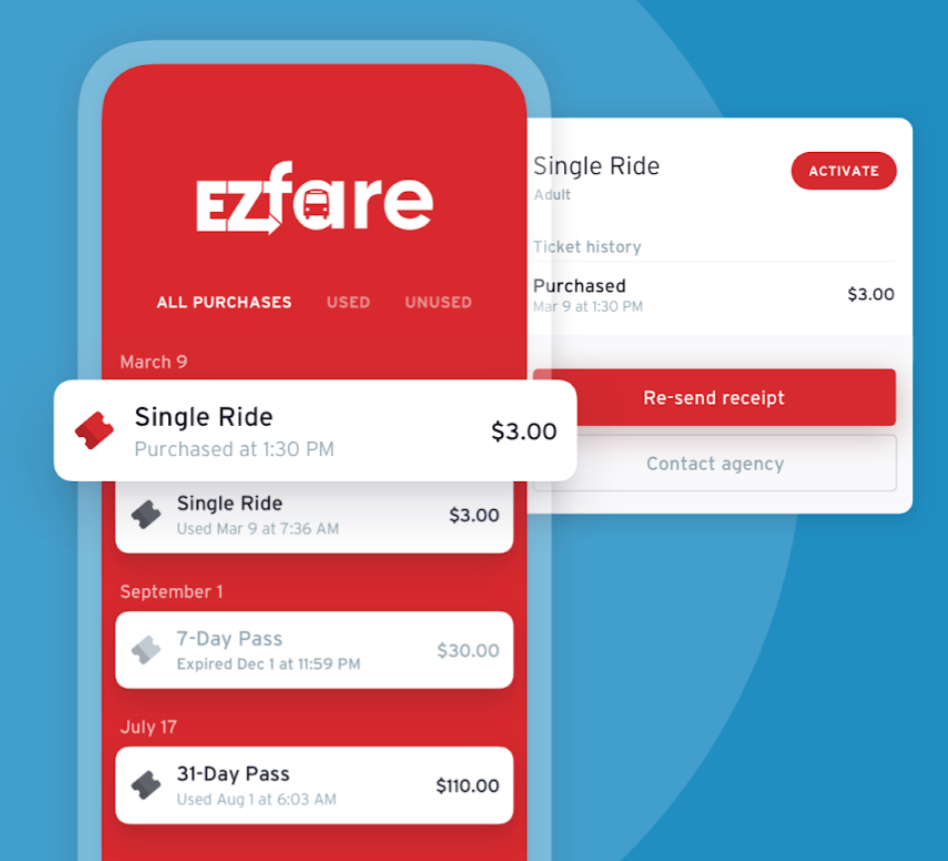

U.S.-based trip-planning app Transit announced it has enabled 500,000 rides from its app for a group of 13 small to mid-tier transit agencies based in the state of Ohio, though mobile ticketing still makes up a small percentage of total rides provided by the agencies.