Article Highlights

The NEORide group is the latest transit agency or group to try to reduce cash acceptance on transit vehicles by enabling customers to buy tickets or load value on smartphones or in account-based cards using cash-collection points.

As of January 2021, cash usage for RTA accounted for 28% of rides, down from 43% in May 2020. But the reduction in cash usage leveled off starting in October 2020, and didn’t drop much after that.

• NEORide

• Masabi

• Dayton RTA

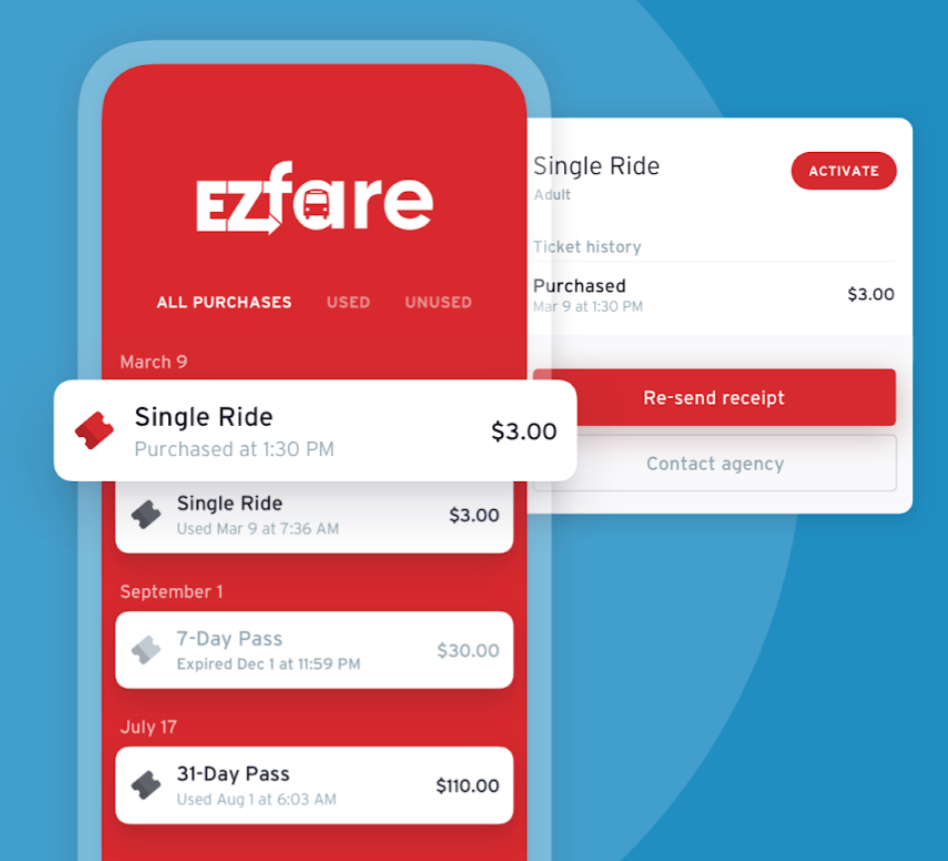

Ohio-based NEORide consortium, a regional transit group that among other things, handles mobile-ticketing fare collection for 13 transit agencies in the U.S. states of Ohio, Kentucky and Michigan, is seeking to reduce cash from its members buses. It’s the latest agency or group to do so.