Article Highlights

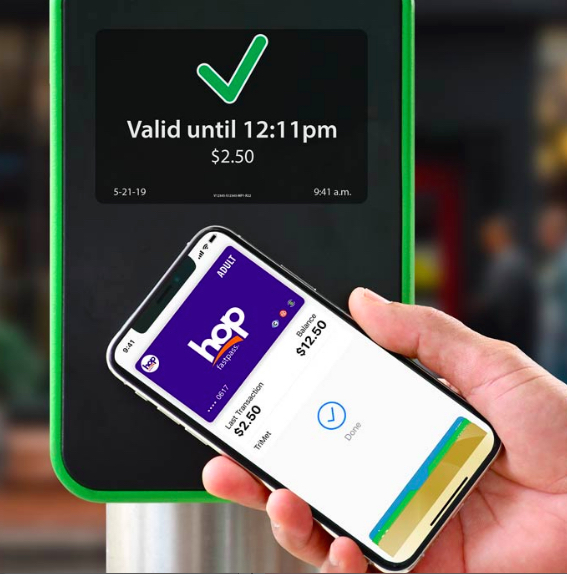

Apple CEO Tim Cook touted integration of Apple Pay with transit authorities in three U.S. markets this year (2019): Portland, Ore., New York City and Chicago. “Transit integration is a major driver of a broader digital wallet adoption, and we’re going to keep up this push to help users leave their wallet at home in more and more instances.”

• Apple

• Mastercard

• Metropolitan Transportation Authority

While noting to financial analysts late Tuesday (July 2019) that Apple Pay is now approaching 1 billion transactions per month globally and is in 47 markets, perhaps Apple CEO Tim Cook’s most significant comments about Apple Pay this week was to again emphasize that Apple wants to enable users to routinely tap to pay for bus, subway and other transit rides with their iPhones and Apple Watches.