Article Highlights

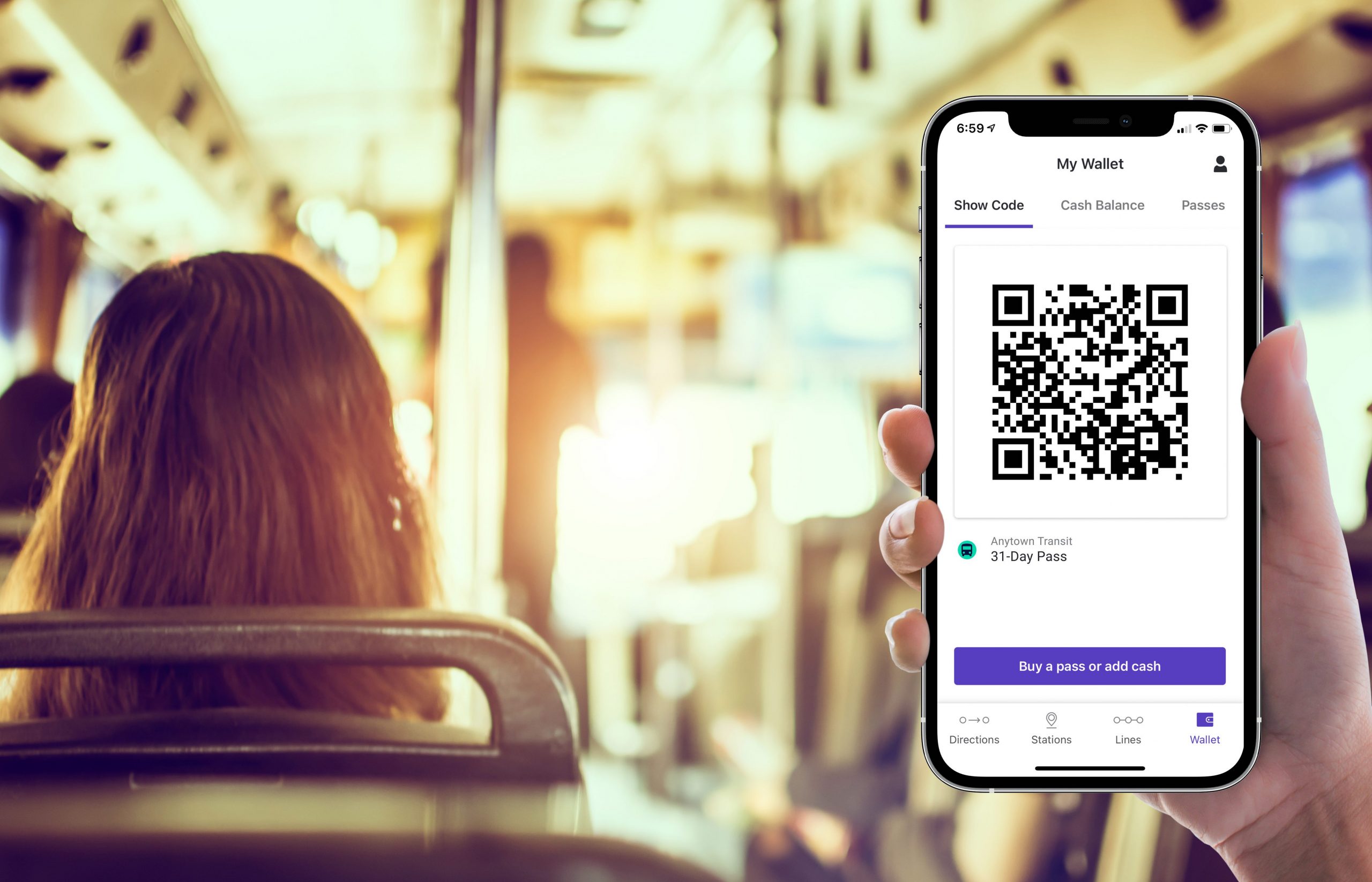

Cubic seeks to stay competitive as more small transit agencies move to digital payments in the wake of the pandemic and as more authorities and operators of all sizes strive to offer their customers such extras as multimodal trip planning, real-time travel information, fare capping and integrated payments spanning regions and various transport modes.

Cubic has a little more than 30 transit agencies under contract to provide mobile ticketing with its Umo Pass service. Rivals Masabi and Token Transit each say they have more than 100 agencies using their respective platforms.

• Cubic

• Moovit

• Masabi

• Token Transit

U.S.-based Cubic Transportation Systems–known for building big bespoke fare-collection systems for such major cities as London, New York, Chicago and Sydney–has begun rolling out its Umo platform, targeting small to mid-tier transit agencies, in addition to its traditional customers.