Article Highlights

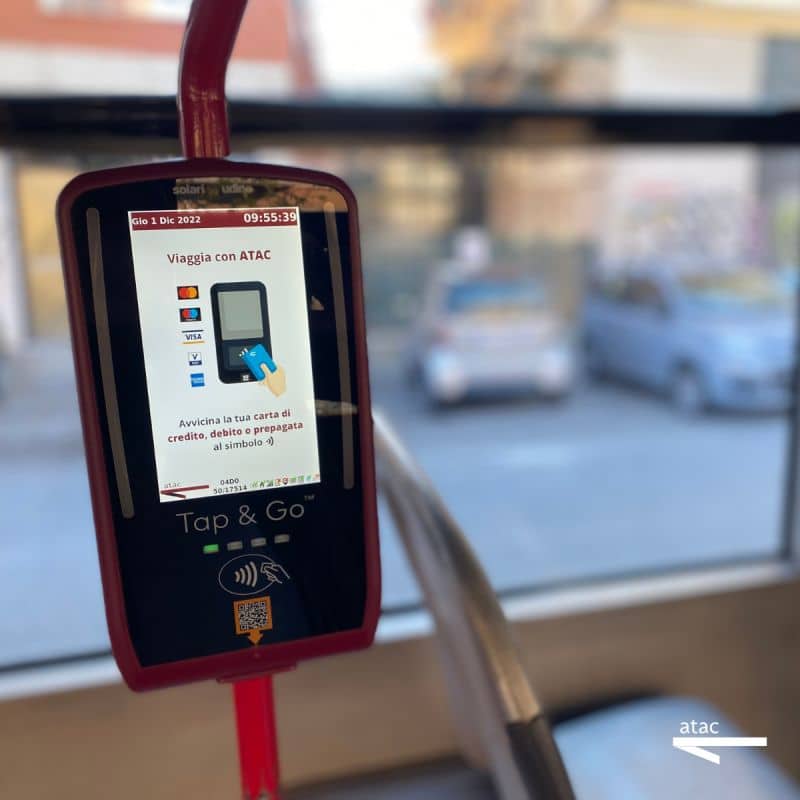

Rome transit operator ATAC announced Thursday that it has begun expanding its open-loop payments service to its buses and trams, more than three years after launching the service on the Rome Metro. The financially troubled operator launched open loop on the city’s three-line metro in 2019.

ATAC launched open loop on the small, three-line Rome Metro in September 2019, and the operator said the percentage of “taps” with contactless cards and NFC devices hit a penetration rate of 23% out of total of first validations in October.

Rome transit operator ATAC announced Thursday that it has begun expanding its open-loop payments service to its buses and trams, more than three years after launching the service on the Rome Metro.